China’s Meddling In Markets Can Hurt Us All

When I think of all the mayhem that is currently Chinese markets, I picture the old Dutch proverb about the boy who sticks his finger in the leaking hole of a dam, only to be besieged by more holes bursting through. In my analogy, the surging water represents the Chinese economy, and the dam represents the central government’s mass of constraints built to exercise control over it. Cracks are appearing in the dam, and as authorities grapple with ways to control the leaks, world market volatility has ensued. The biggest fear I have about this volatility, however, is the observation that the Chinese authorities are doing their best to stop the volatility. We need the stock market to correct, and we should hope for a larger currency depreciation. Without such safety valves, the Chinese economy will have a hard landing, and that could push an already fragile world recovery back into recession.

The pressure on the Chinese “dam” has been building for years, especially since the 2008 crisis. Over the last decade, pundits have begrudgingly applauded the Chinese authorities’ ability to grow a massive economy while keeping control of the country firmly in the hands of the central government. When the crisis hit, China’s government tried to soften the blow to the economy by spending massively on infrastructure (which fueled global commodity prices and helped many emerging markets perform well). When that engine slowed, authorities pressed the pedal on real estate lending, fueling a property boom. In the wake of the short-term fixes, China has been left with some cracks in the dam: a glut of unused commodities, and big piles of bad debt.

Simultaneously, authorities have been trying to liberalize China’s financial markets, while keeping tight restrictions on the flow of capital. They limit how much citizens can invest abroad, and in what manner and size foreigners can access Chinese industries or investments. The government controls the access to property for development, and how much credit can be extended for this purpose. Domestic investors thus are very limited in where they can place their wealth: bank accounts, property, or the stock market. Likewise, foreign investors, eager to gain access to the Chinese consumer and growth story, have poured capital into the country. With lots of money chasing relatively fewer assets, prices over the last five years climbed to what now seems like bubble territory.

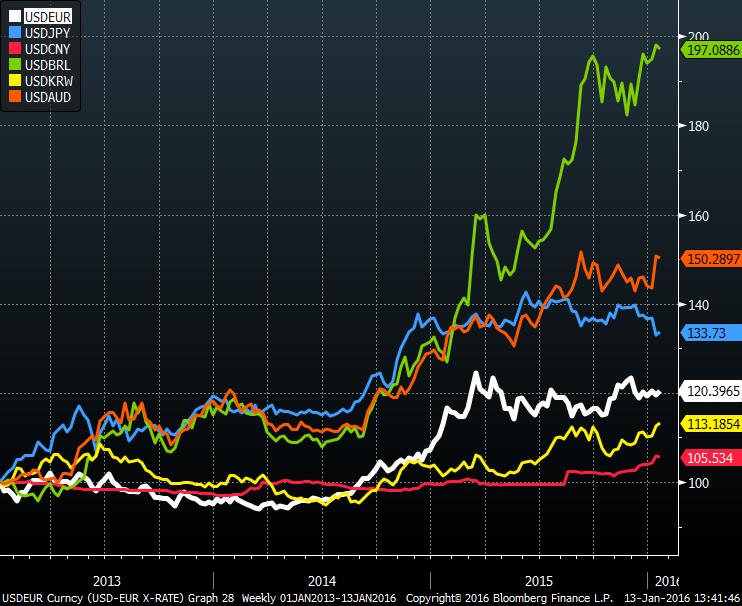

Exchange Rate Moves, Normalized January 2013

Source: Bloomberg

As the bubbles threatened to burst, authorities sought to maintain control by keeping a tight rein over the majority of domestic interest rates and the exchange rate. When the economy slowed, they brought interest rates lower in order to spur lending. However, worried about rising debt burdens, they also limited the type and quantity of loans, blunting the efficacy of this policy tool. Seeing the lack of response in the economy, domestic investors began to panic and the stock market plummeted in July 2015. Worried about repercussions on sentiment, authorities sought to control these prices as well, by forcing government entities to buy stocks, and restricting selling. With limits on lending and limits on stock price movements, imagine lots of fingers inserted into the holes of the Chinese economy.

The Federal Reserve’s hiking of U.S. interest rates is likely the final blow to this pressured system. As U.S. monetary policy has been getting tighter since the end of quantitative easing, the dollar has strengthened significantly against almost all currencies – except the Chinese yuan. The figure shows the extent to which China’s government has constrained their currency relative to the rest of the world’s moves since 2013. South Korea’s won (KRW) has weakened 13%, while the euro (EUR) has fallen 20%. The Japanese yen (JPY) is off by over 33%, while the Australian dollar (AUD) has depreciated by half. Brazil, one of the largest movers since 2013, has fallen to 25% of its original value, while China has moved a miniscule 5%. The only way China’s government has been able to control the slide has been by selling massive amounts of dollars in reserves and buying the yuan investors are selling. At this point, imagine an entire hand’s worth of fingers inserted into the leaks in the dam.

As I argued in a previous article, “China Devaluation is Good News,” freely moving prices, especially exchange rates, work like a shock absorber for a country’s economy (click here for the story). If prices are not allowed to move, and capital is not allowed to flow more freely, the Chinese economy will be the one moving part that will take the hit. Authorities have enough power to keep the lid on volatility in financial markets– but the cost is high. The more they control financial prices, the more the world’s stock, bond, and commodity markets reflect the probability of a hard landing in China, which will in turn damage a fragile global economy. I’d much prefer to see China’s stock market find its bottom, and the currency to move another 10%, than witness its economy tank. Something has to give.