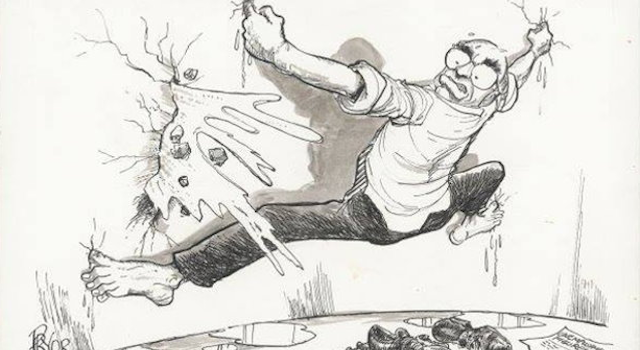

When I think of all the mayhem that is currently Chinese markets, I picture the old Dutch proverb about the boy who sticks his finger in the leaking hole of a dam, only to be besieged by more holes bursting through. In my analogy, the surging water represents the Chinese economy, and the dam represents the central government’s mass of…

Tag Archives #investments

A new era is beginning in Argentina, now that the Kirchner dynasty was finally voted out of office in November. President Mauricio Macri has vowed extensive change for the country, in areas ranging from foreign policy to the domestic economy, advocating an increased role for the private sector at the expense of a reduced role for the government. Argentine assets…

Two weeks ago I traveled to South Africa, in order to create a two-year economic and investment roadmap. After seven days of meetings, I returned with a bearish view for the economy both cyclically and structurally. Unlike previous visits over the past decade, I could find very few glimmers of hope. Gloom is hard to trade on, as the timeframe…

Investors have lost faith in Brazil, and rightfully so. The currency has lost 36% of its value against the U.S. dollar this year, plunging nearly 7% in the last week alone. Yields on its bond issues are spiking, as investors demand higher and higher rates to loan Brazil or Brazilian companies money. Just six years ago in November 2009, Brazil…

Big Move in China's Yuan Today! Value of the Chinese currency, the yuan, against the US dollar. Source: Bloomberg Global markets woke excited today after China’s central bank surprised the world by “forcing” a 1.9% weakening of its currency. Most currencies in the world move in a relatively free fashion, i.e. without significant intervention by a country’s central bank. A 2% one-day…

Back in the summer of 2013, when I was managing over US$10 billion in emerging markets (EM) fixed income assets, I looked around the industry at my fellow EM portfolio managers and saw a stunned group. In early May that year, Ben Bernanke shocked the world out of its complacency by announcing that the Federal Reserve was ready to taper its…