Argentina: Get Ready To Invest (And Travel!)

A new era is beginning in Argentina, now that the Kirchner dynasty was finally voted out of office in November. President Mauricio Macri has vowed extensive change for the country, in areas ranging from foreign policy to the domestic economy, advocating an increased role for the private sector at the expense of a reduced role for the government. Argentine assets have not been part of a favorable or investable universe for over a decade; if successful, Macri’s policies will bring sorely needed foreign investment into Argentina, and spur locals into putting capital to work as well. As such, I’m monitoring the country as a possibly lucrative investment location for 2016. With interest rates at 38% and a currency weakened by over 30%, the time is coming nearer.

As a first credible sign that Macri is putting action behind his promises, he has brought new (and valuable former) employees into three important institutions: the finance ministry, the central bank (BCRA) and the statistics agency (Indec). Many years have gone by since investors in the country could depend on any of these institutions for predictability, for transparency, or to enact policies that would actually spur economic growth and contain inflation. With a new “orthodox” finance minister and central bank governor at the helm, investors will likely become more confident that the economy will be in much better shape in the years ahead.

Furthermore, I imagine that by the end of 2016, investors will also be able to believe the data that is produced by the government. As a panelist at an emerging markets conference in 2004, I remember telling the assembled group of investors that I had no intention of buying any “indexed” Argentine asset – like local currency inflation linked bonds, or USD-denominated GDP bonds/warrants – because I didn’t believe the numbers, they were fake. Sure enough, over subsequent years, the Kirchner administrations essentially took over the independent statistics agency, firing staff, and massaged the data to tell a pro-government story. Investors were short-changed as a result. If the data is truly reformed, these fixed income securities could once again become viable investments.

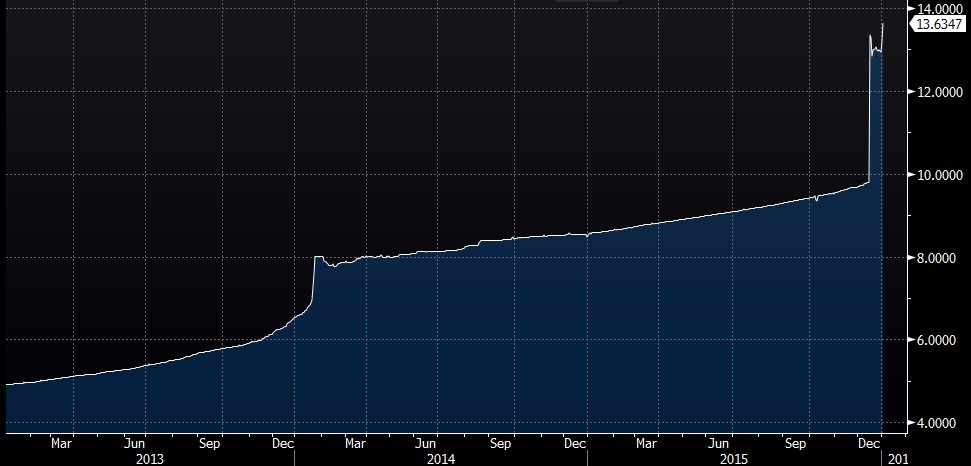

While these actions will immediately make Argentina appear ‘prettier’ as an investment, other actions are making it look cheaper. On December 17, the finance minister announced that the government and central bank were abandoning the strictly managed exchange rate regime, and allowing the currency to float to a demand and supply driven level. This action was critical, as the central bank was running out of liquidity to support the wildly inflated old system. As the following chart shows, the peso depreciated by more than 30%, moving much closer to the black market rate where most “unofficial” dollar transactions occurred. Since this move, the currency appears to be settling, and officials report that international reserves are on the rise already.

Exchange Rate for the Argentine Peso (pesos per USD, higher is weaker)

Source: Bloomberg

Furthermore, the central bank raised rates to a hefty 38%, and appears to be ready to raise them further in order to combat any depreciation-induced inflation. Since emerging markets are not in investors’ good books at the moment, real rates need to remain positive in order for the peso to stabilize and for the country to attract inflows. With inflation already north of 25%, and a currency 30% weaker, interest rates are likely to remain high.

For those of us with dollars (or any developed market currency) to spend or invest, the depreciation makes Argentine local currency goods and investments around 30% cheaper. The high interest rates also look more appealing. In the coming quarters, we will likely have a better idea where inflation and the currency settle. It will also take some time to learn whether President Macri is able to work in the system that has many roadblocks to reform. In that timeframe, investors would be wise to do some research and get ready for investing in local currency assets. At a minimum, a trip down to Buenos Aires will be considerably cheaper – time to stock up on leather goods and consume that famous wine and beef!