Tank Tops: The Glut Of Oil Spills Over, Prices To Fall Further

Oil prices have been under pressure, and it’s all about supply. The world is experiencing a glut of oil production, with no likely slowdown until the end of 2016. The market rout looks to continue well into the first quarter of next year, with price per barrel heading into the $20s, as oil producers keep pumping and large regions of the world run out of places to store it. In fact, analysts are talking about growing probabilities of a relatively rare phenomenon in the oil industry: tank tops.

No, this is not a matter of a warm winter inducing us all to go into our storage closet to pull out sleeveless shirts. Oil analysts get very worried about falling oil prices when they see “tanks” get filled close to the “top.” For many months now, the market has been in an oversupplied state; Citibank’s commodity team estimates that in early 2015, the excess supply was around 1.2 million barrels per day (b/d), with demand consuming around 95 million b/d, and supply contributing 96.2 million b/d. Goldman’s commodity team estimates the excess supply at 1.5 million b/d in the fourth quarter of 2015. While China and India (and even the U.S. in the past) often accumulate additional oil for strategic purposes, the excess supply globally has been slowly filling up the world’s storage tanks.

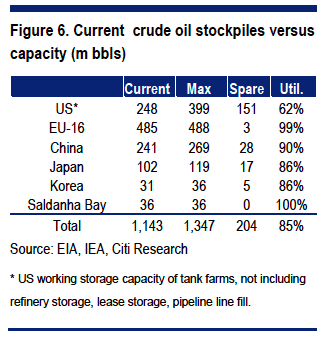

The storage facilities are located globally, some on land, and others on sea. While the U.S. still has plenty of storage, Europe is nearly full capacity already. As a figure in Citibank’s December 14 article “Oil: How Low Can It Go?” by Edward Morse and team shows, the European Union is at 99% of its capacity. Other regions are creeping higher, and analysts are betting on a higher probability of Asia joining Europe’s predicament.

What happens when the tanks are full? First, producers can utilize more expensive “floating” storage facilities, by renting oil tankers at sea to hold the cargo until demand picks up. Second, the “full” regions could theoretically send the oil to the U.S where some storage still exists. However, at the current rate of oversupply, the U.S. spare capacity of 150-200 million barrels could very well be challenged during the first half of 2016. Therefore, the overwhelmingly likely outcome of tank tops is that prices have to fall even more in order to clear the market.

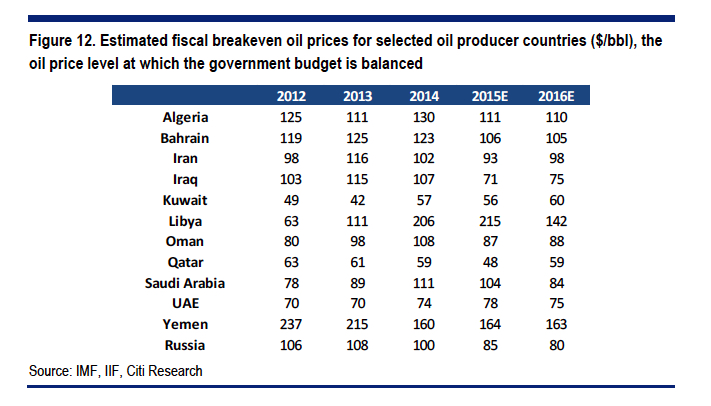

Normally, with faced with such an oversupplied market, producers would logically cut back in order to maintain higher prices. At this time, however, every oil-exporting country has an incentive to keep pumping regardless of price. Many like Saudi Arabia are worried about market share and are willing to lose money to maintain it. Others have onerous fiscal needs and are entirely dependent on oil revenues to keep the government afloat. They must keep pumping in order to pay the bills. Figure 12 from Citibank’s report shows just how dire the situation is for many of these countries. Iran needs oil at $98 to balance its budget, while Libya needs $142. With oil currently in the mid $30s, these countries have severe financial strains.

Most importantly for 2016, Iran is due to come online as sanctions fall away. Iran’s oil flows could reach both Asia and Europe by the end of the first quarter; a conservative estimate would entail Iran providing 300 thousand b/d sometime in Q1 – though its government is actually targeting 500 thousand immediately in January.

Oversupplied conditions are going to get worse before producers adjust. Ultimately, when oil prices fall to or below the cost of production, some producers will have to shut down, as they will not be able to generate enough cash or attract financing to keep operations going. Some countries and companies are already at these cash cost levels; while most have cut capital expenditures, they have still been able to borrow and keep on pumping. Until they turn off the tap, it’s not time to buy oil.