Saudi, Shale & Iran: Everything You Need to Know About the Oil Crisis

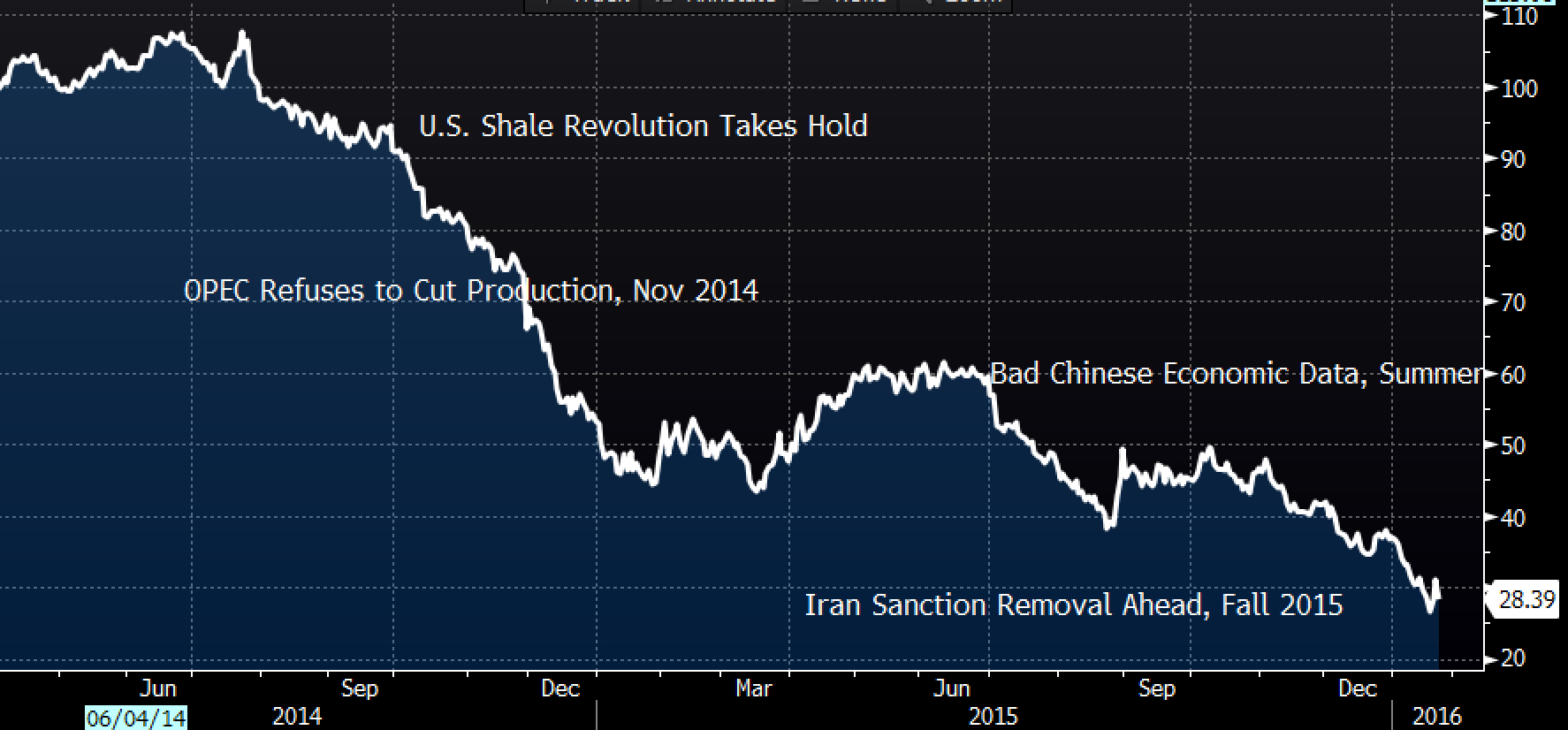

In just 15 trading days, oil prices have managed to plunge another 20%, after a fall of 29% in 2015 and 44% in 2014. While markets took these drops in stride in the past few years, something seems different about the volatile plunge so far in 2016.

Why are oil prices so low? And why are the world’s asset markets so worked up about it?

Oil prices are low because both demand and supply forces are conspiring to make it so. Why markets are terrified is another story.

First, the demand for oil is highly correlated to economic activity, which currently is looking rather weak in cyclical terms. In good times, consumers typically have growing income and thus have a higher demand for goods. Companies, ever eager to supply these goods, have to run factories longer or faster, and demand more energy to do so. More goods get produced, more get transported, and more people drive to buy them or to deliver them. In fact, according to the U.S. Energy Information Administration (https://www.eia.gov/) about 75% of the petroleum used in the USA in 2014 was for gas, heating oil, diesel, and jet fuel.

The top 5 oil-consuming countries in the world (at least in the last few years) are the U.S., China, Japan, India, and Russia. Combining all the member countries in Europe would bring this region high in the ranks. None of these have shown stellar economic growth in the past few years. In fact, many emerging markets such as Russia are suffering significant recessions. The U.S., while not in a recession, appears to be in the midst of a soft patch. Japan and Europe still have weak economies, and policymakers are trying – with little success – to boost growth. Investors are focusing their fears on China, the #2 consumer of oil in the world as the country’s economic growth rate continues to inch lower, and for once, its government apparently isn’t able to turn around the decline.

As such, the global demand for oil is just not very strong. Low demand brings low prices.

However, the real story behind the plunge in oil prices lies in supply. The United States’ shale gas revolution has turned out to be a permanent game changer for world oil supply. In fact, in 2014 the International Energy Agency reported that the U.S. had become the largest oil and natural gas producer, surpassing both Russia and Saudi Arabia. This addition to the global oil market was enough to induce oil prices to fall from their highs above $100 per barrel to levels in the $70s.

Typically when prices fall, OPEC comes to the rescue. OPEC, the Organization of Petroleum Exporting Countries, has historically controlled the majority of the oil’s supply, and tended to increase production when prices were “too high” and cut production with prices fell “too much.” The November 2014 OPEC meeting delivered a significant shock to the world; instead of cutting production to prop up prices, Saudi Arabia in particular showed it was prepared to keep pumping and even lose money, in order to try to force the new higher cost producers out of the market. Over the course of 2015, rather than getting forced out, U.S. shale producers innovated and cut costs, and survived even as prices fell to $50 a barrel.

Meanwhile, over the course of 2015, non-OPEC oil producers kept their pumps on at full steam as well. Most of these countries’ fiscal balances were under severe financial strain. As government budgets had been relying on significantly higher oil prices, politicians were short on money and yet still reliant on oil revenues. They had to maximize oil production in order to get money in the coffers.

These issues were dominant drivers of supply from 2014-2015. However, as 2015 came to a close, yet another oil producer was about to enter the scene: Iran. The elimination of Iran’s sanctions means that the country will once again export to the world’s markets. Iran’s government has stated intentions to produce 500,000 barrels a day, which in a market that is already oversupplied by over 1 million barrels per day, is enough to cause further disruption. Iran desperately needs the oil revenues to buy crucially needed imports; the country has every incentive to maximize all exports of oil it can.

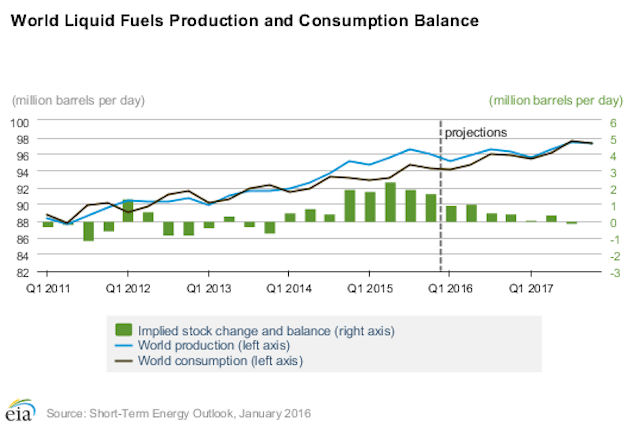

Finally, the last nail in the coffin of oil prices is the growing likelihood that the world runs out of space near-term to hold all the oil being produced, a phenomena called tank tops. In my Forbes article December 22, 2015 (click HERE ) I showed data indicating world storage was filling up, and only the U.S. had much spare capacity. With continued global excess supply, this spare storage could likely get full in the first half of the year.

In sum, oil is getting pumped out of the ground at maximum output, by a whole host of new producers, and there are not many places to put it since demand is relatively weak. In the latest energy outlook produced by the U.S. Energy Information Administration, the oversupply will continue for all of 2016 (see chart above). As a basic rule of economics, the only way to clear this surplus from the system is for prices to become very cheap and clear excess supply. With very low prices, consumers will demand more, and/or producers will get priced out of the market and production will fall. The price volatility we have recently witnessed as oil shoots up and down by 5-7% daily, from $26-31 per barrel, suggests that we are getting close to that clearing price.