Oil Prices: Low for Longer

Driving into the gas station this morning, I was thrilled to see I could fill up my car with top-grade gasoline for under $3.00 a gallon (and yes, that is much higher than the U.S. average since I have the fortune to pay Connecticut taxes). With today’s news from OPEC, it looks like I can enjoy “cheap” gas for months to come.

Oil prices – along with other commodity prices – have plummeted over the past year due to both demand and supply forces. On the demand side, a faltering global economy has translated into blunted needs from consumers and producers alike. China has taken the brunt of the blame for the fall in demand, as GDP growth has slipped under 7% for the first time since 2009. Indeed, as China has been reorienting its growth drivers, from infrastructure (building highways, railroads and massive commercial complexes) to consumption, the country naturally requires less raw materials. The rest of the world has also contributed to lower demand, given most nations are operating well below their economic peak. Weather patterns are expected to play a role over the next few months, given that El Niño is projected to deliver warmer temperatures, and thus less demand for heat.

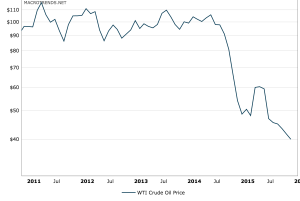

However, the real story lies in supply. In oil’s case, there is just too much of it in the system, and producers are not slowing the rate of production. A few years ago, the United States’ shale gas revolution became a reality. In fact, in 2014 the International Energy Agency reported that the U.S. had become the largest oil and natural gas producer, surpassing both Russia and Saudi Arabia. This addition to the global oil market was enough to induce oil prices to fall from their highs above $100 per barrel to levels in the $70s. The death blow to prices was delivered at the OPEC meeting in November 2014, where much to the market’s surprise, the cartel indicated that it would not cut production. While clearly these producers were concerned with losing market share, perhaps more importantly, their countries’ fiscal balances were under severe financial strain. Government budgets had been relying on significantly higher oil prices; at the same time, growth was slowing, and social pressures were building. The OPEC nations could not afford to suffer lower oil revenues.

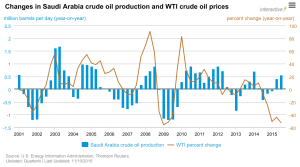

The supply story is little changed today, as the glut is growing from a variety of channels. Surprising forecasters, U.S. producers became more efficient in production over the last two years and have weathered the lower oil prices for much longer than predicted. Oil rig counts have fallen dramatically, but the U.S. is still pumping large volumes. Globally, the fiscal balances in most oil producers have worsened so that the need for oil revenues is even more pronounced; this problem is most evident in emerging markets. Therefore, OPEC announced today that once again, it will not reduce production levels. OPEC is a classic player in a case of Prisoner’s Dilemma. In contrast with the 1970s, there are now several large producers who are not members, who cannot or will not collude with the cartel. Every oil producer would be better off if they all agreed to cut production, but rationally out of self-interest they choose not to cooperate. As such, as the chart below shows, Saudi Arabia’s production no longer controls oil prices.

On top of these supply issues, Iran is expected to start pumping and exporting oil in the coming year when sanctions are removed. The World Bank has estimated that oil prices could fall $10 a barrel as a result of Iran’s addition of around a million barrels a day. Of course while some of Iran’s production is likely priced into the market expectations, the potential impact remains significant.

These issues are the grim reality facing oil suppliers over the next few months – to the joy of us motorists and plane passengers and residents of cold winter states. Low oil prices have beneficial impact on all consumers through low inflation (low interest rates for longer!) and higher disposable income, which should in turn contribute to higher economic growth. Significant importers, countries like Turkey, China and Japan, are obvious winners. Ironically, low prices are no longer a win-win for the United States; now that America is a major oil exporter, the negative production impact could offset consumer gains. We will need to watch the unemployment consequences in Texas and North Dakota, along with the impact on the stock market and fiscal revenues. For now, fill ‘er up and go on a road trip!